Strengthening the Fight Against Financial Crime

Introduction

Criminals launder over $40 billion through Canadian banks every year and only 0.01% of criminal activities are currently intercepted. During times of economic turbulence like recessions and pandemics, financial crime activities skyrocket. The onset of COVID-19 compelled the Royal Bank of Canada (RBC), Canada's largest bank, to seek a more powerful way of combating financial crime.

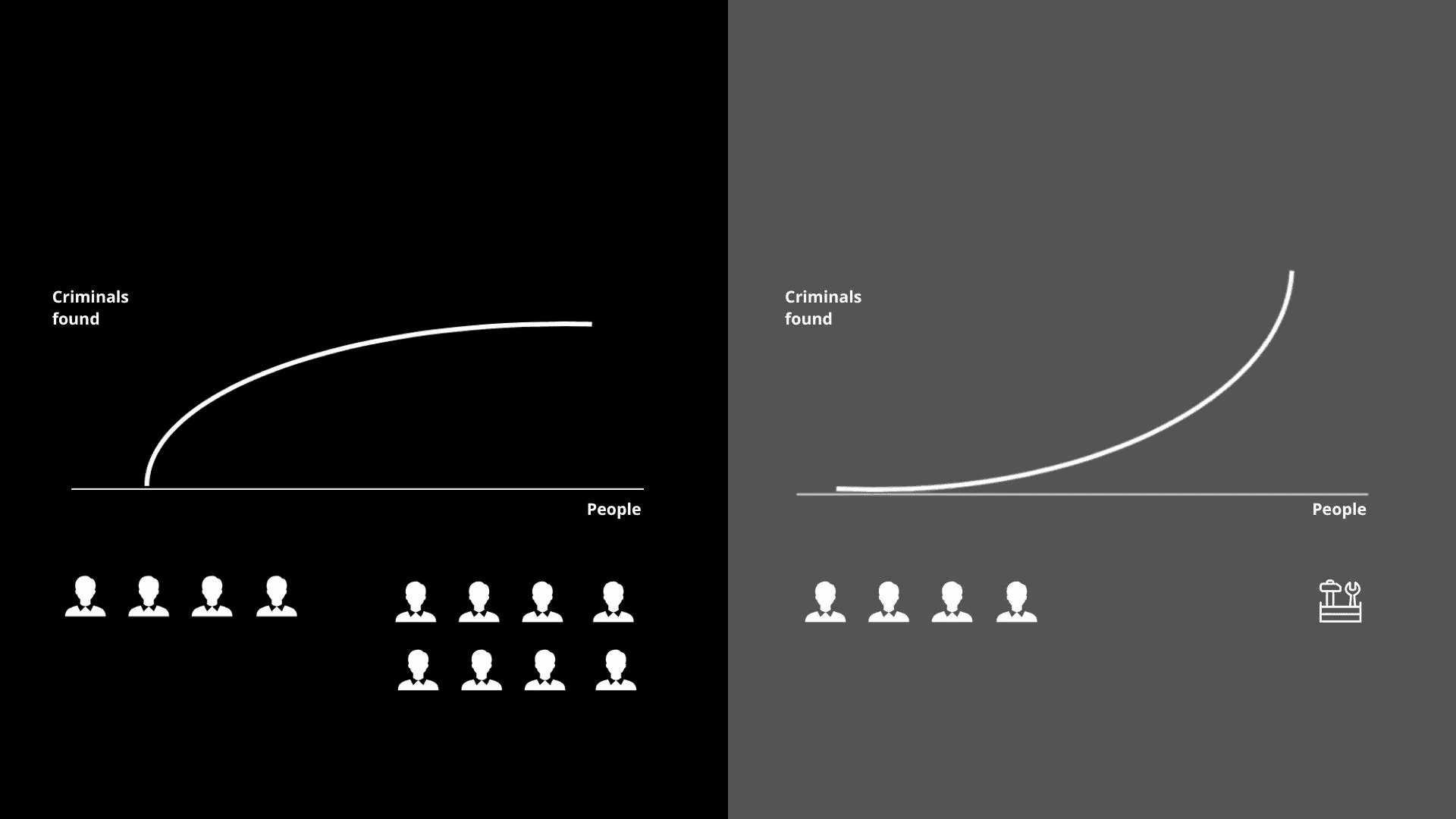

As part of RBC’s innovation program, I conceived and designed a tool to empower analysts to identify 4x as many criminals within public news.

Timeline

May 2020 - August 2020

Key Skills

0 to 1 product

Innovation

Product strategy

UI/UX Design

Role

I designed this tool end-to-end: research, analysis, problem definition, product design, usability testing, and storytelling.

Team

1 Product Designer (me)

1 Data Scientist

1 Developer

1 Business Analyst

Results

✅ Got buy-in from RBC’s VP of Financial Crime to fund this project.

🏆 Received an award for best product branding in program.

💰 Saved RBC $500,000 over the course of 5 years.

📜 RBC supported provisional patent for our ML models.

The Problem

Banks can prevent criminals from becoming clients through extensive background checks. They can also track financial information to detect crime within RBC. However, it’s hard to know if a client has committed a financial crime at another bank or external organization, in which case RBC might not want them to continue being a client.

A special team of analysts sift through news and social media for financial crime-related information, comparing names with the RBC client directory. Matches are flagged and escalated, but with the overwhelming volume of daily posts and articles, analysts cannot detect every instance.

The opportunity

How can we support RBC analysts in getting qualified criminal leads from news and social media?

The Goal

Increase the number of financial crime leads analysts are currently getting from news and social media.

My Hypothesis

By scraping information from news articles and social media, and cross-referencing the names with the client directory, I expected to streamline the process for analysts to find relevant information easily.

The Constraints

I consulted our stakeholders, lawyers and compliance team members to understand the main concerns regarding financial crime tools at the bank. Here are the main findings from those conversations:

We cannot scrape news websites and social media for data.

We cannot do background checks on a client without any reason to look into them.

Labeling a client as a potential financial crime risk should be done so very carefully and with significant cause. We cannot label someone as a financial crime risk if we don’t have reasonable cause to look into them.

We must be GDPR compliant as we have a head office in the UK and also serve clients in the EU.

So, decreasing the number of criminals through public news would be difficult to do without being able to look up clients or effectively scrape public news. So, we decided to talk to the analysts who work on this search daily.

Understanding users

I interviewed 20 analysts to dig into the current process of finding and reporting potential clients.

Motivation Tied to Case Impact

When analysts aren't actively involved in cases after reporting, they become demotivated. The most exciting part of their job is working on bigger cases. Job satisfaction is typically low but increases significantly when they work on high-risk cases.

Small Sources Give Early Signals

Local newspapers are significantly better at detecting early instances of financial crime. Larger newspapers mostly report on issues once they've become large enough. Even huge financial crime cases like Jeffrey Epstein were caught by a smaller newspaper: the Miami Herald.

Rigid Case Updates

Once a client is reported, you cannot update their information. If a client commits a larger fraud after being reported, you must delete the entire case and start over. This puts the case back at the front of the evaluation queue.

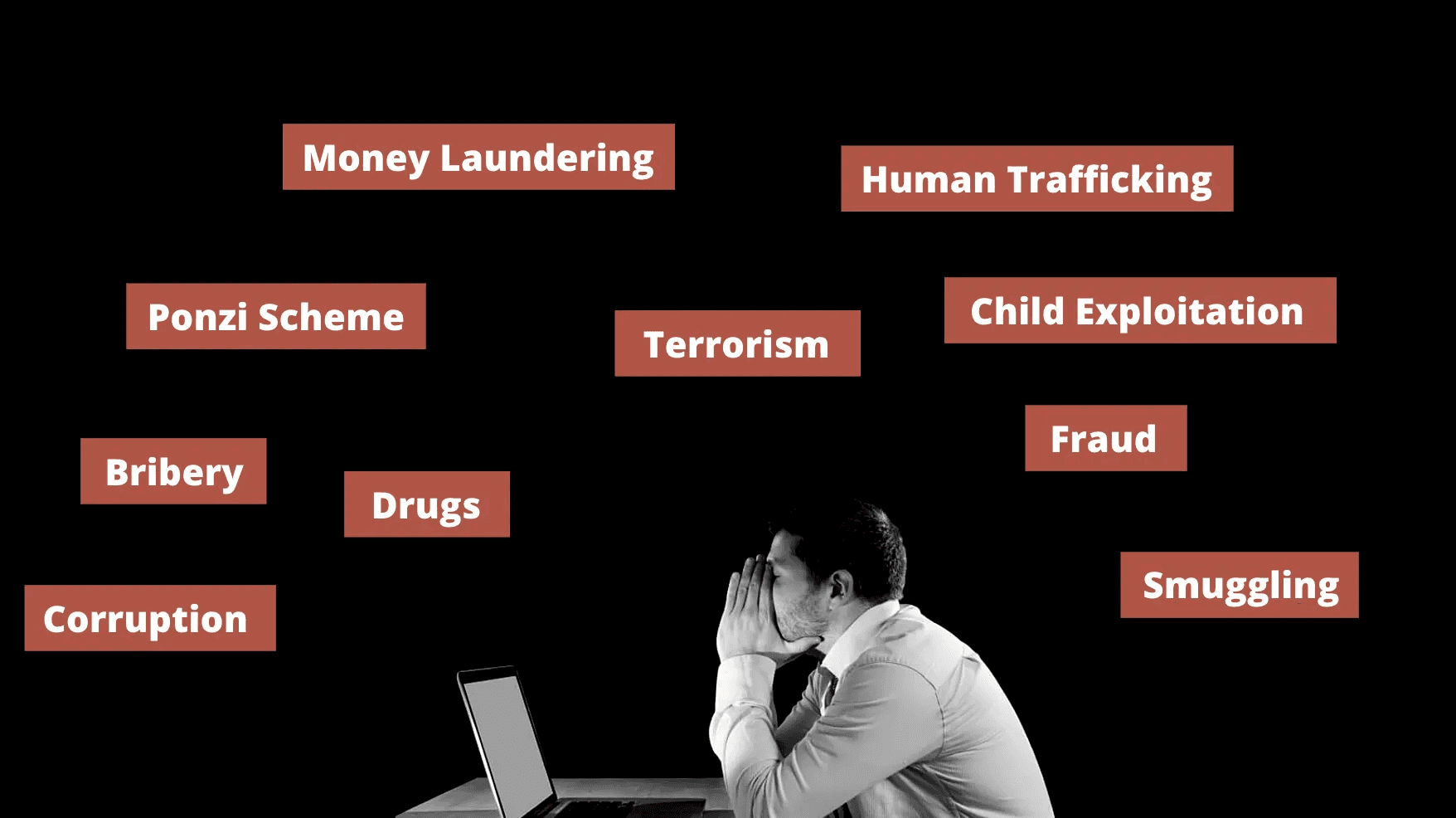

Equal Effort, Unequal Crime

While analysts spend equal time investigating all financial crimes, some are considered significantly worse than others.

Fragmented Tooling

Analysts were using over 6 tools (considered to be a lot) throughout this process.

News-First Research

News was the primary source of information finding. Social media was used to supplement the information.

the product strategy

Through conversations with analysts, stakeholders and legal team, we discovered many areas where our efforts could make a difference. We wanted to strike the right balance between having a substantial impact towards combatting financial crime and shipping an MVP within a 3 month time frame.

Research showed that analysts spent equal time on all financial crimes, but one stood out as significantly worse: human trafficking. This crime was challenging to detect within the financial system, often masquerading as something else, and had devastating consequences beyond monetary losses.

Our strategy focused on empowering analysts to target high-risk human trafficking criminals, maximizing impact in the fight against financial crime, while also enhancing job satisfaction and motivation.

solution

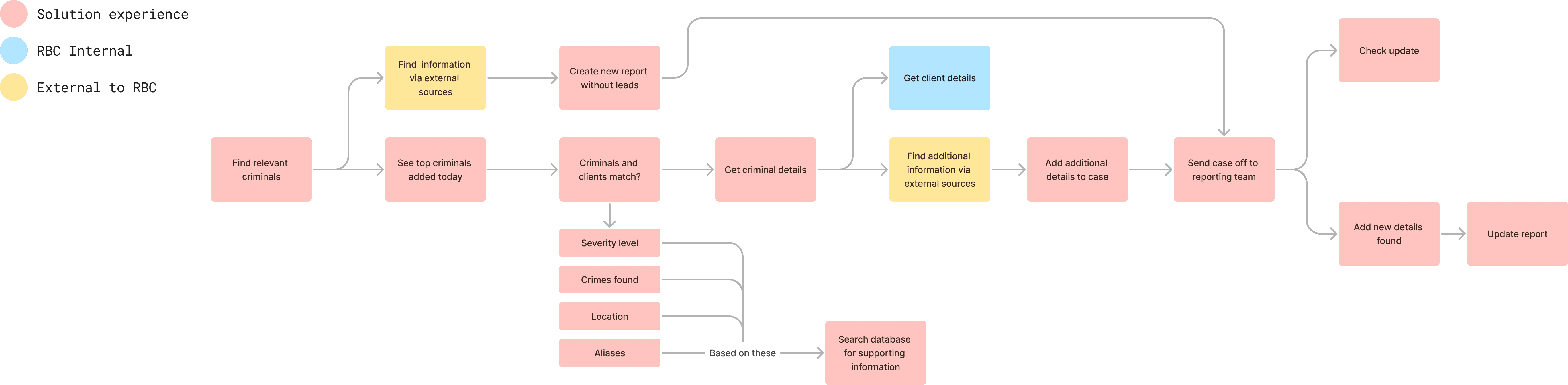

We looked for a vendor product with an up-to-date list of high-to-medium risk criminals. This product was updated daily with a list of new found criminals. Using this data, we cross-referenced it with the RBC client directory and created an NLP Engine with 3 ML models to assign severity to flagged clients.

The 3 ML models:

Classification: is this a financial crime or not?

Relevancy: what information is important for RBC?

Context: what kind of crime is it?

MVP Features

Highlight criminals according to risk factor

Indicate if there is a match between a criminal versus RBC client

Showcase relevant criminal information in one spot

Allow analysts to update information about a case

Expedite client reporting process